Why Nigerian Businesses Without Proper Records Are at Risk in this New Tax Era

Most Nigerian business owners are fighting loud battles:

Sales. Customers. Rising costs. Competition.

But a quiet change is happening in the background, and many people are missing it.

This change will decide which businesses survive the next 5–10 years.

It is not about social media.

It is not about trends.

It is about how visible, provable, and documented your business is.

For years, business in Nigeria ran on trust.

“My uncle knows him.”

“Someone introduced us.”

“I’ve been buying from her since 2019.”

That system worked but it had limits. It kept many businesses small and invisible.

Today, things are different.

Under the current Tinubu tax reforms, the focus is clear:

Who is doing business, how they are doing it, and how often.

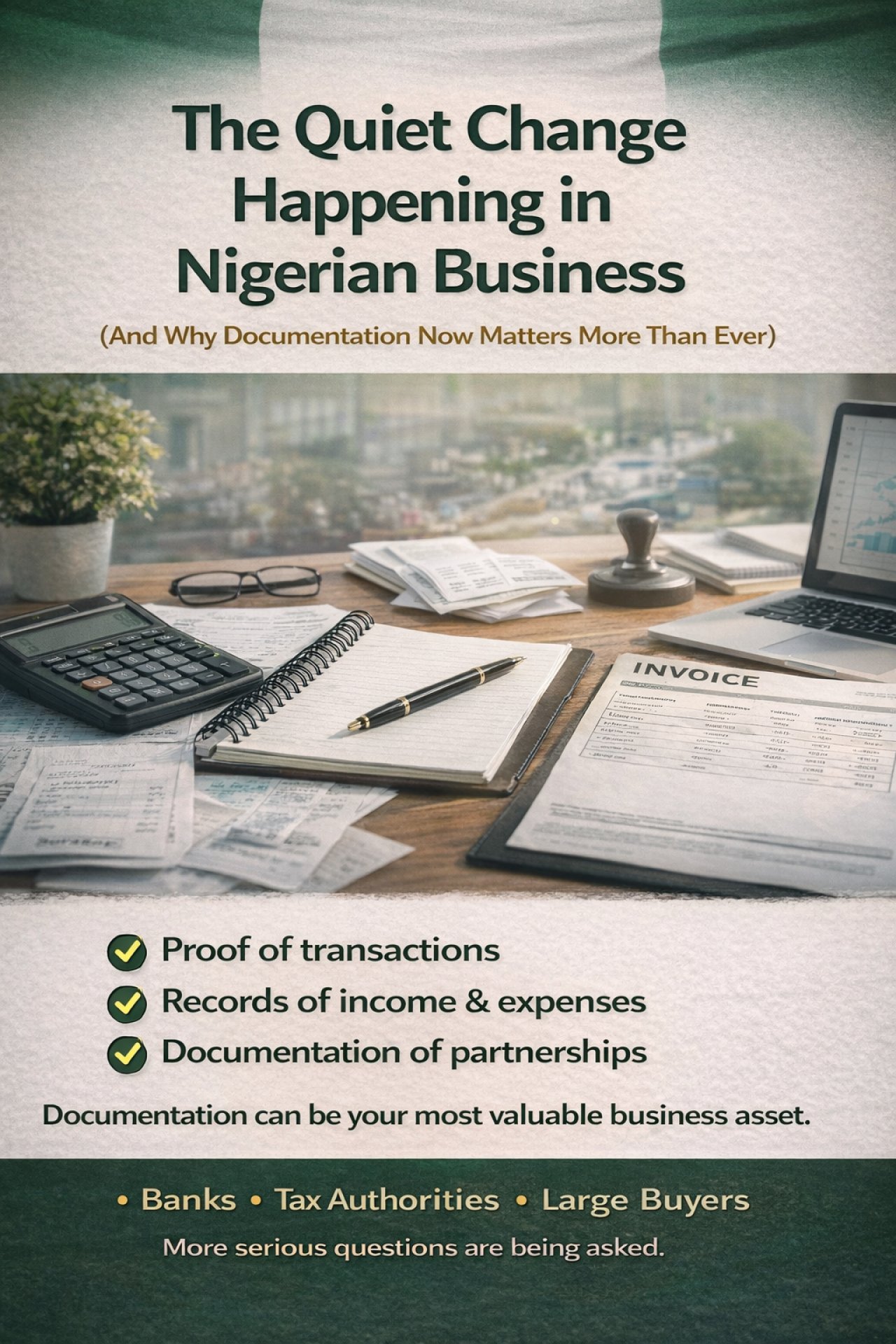

Banks, large buyers, tax authorities, and government agencies are no longer asking stories.

They are asking questions like:

Can this business be verified?

Is there documentation of transactions?

Can we trace business activity over time?

This shift is quiet, but it is serious.

Let’s be very clear.

The new tax direction is not really about punishing businesses.

It is about bringing more businesses into the formal system.

If your business has no records, two things happen:

1. You look invisible, even when you’re working hard

2. You have no proof when questions come up

Here’s the part many people don’t know:

Taxes are discussed using documents and receipts, not explanations.

If you can show:

who you sell to

what you sell

how often you sell

basic records of income and expenses

you are in a much stronger position to:

explain your numbers

avoid being overestimated

claim allowable expenses

protect yourself from “guesswork tax”

Many Nigerian businesses will pay more tax than they should not because they earn more, but because they have nothing to show.

This can be avoided if you have a proper documentation of your business and transactions

Proper documentation does not automatically mean higher taxes.

In many cases, it leads to fairer and more accurate taxes.

Stop seeing documentation as stress.

Start seeing it as business insurance.

Every serious business in Nigeria will eventually need:

proof of activity

proof of relationships

proof of consistency

The earlier you build this habit, the safer your business becomes.

Nigeria is not getting harder for businesses.

It is getting more structured.

Under this new tax era, visibility and documentation are no longer optional.

They are protection.

Your product matters.

Your network matters.

But your documentation may be the most valuable asset you’ll ever build.